Types of reinsurance structures offered.

- Layered or quota share facultative (D&F) reinsurance, accessed globally, for single-parent captives and risk retention groups (RRGs)

- Treaty reinsurance for mutual insurance companies seeking a more innovative solution than is offered under a traditional treaty reinsurance structure

- Loss portfolio transfer solutions to laser out specific risks from the captive

- Issuing carrier and fronting partnerships

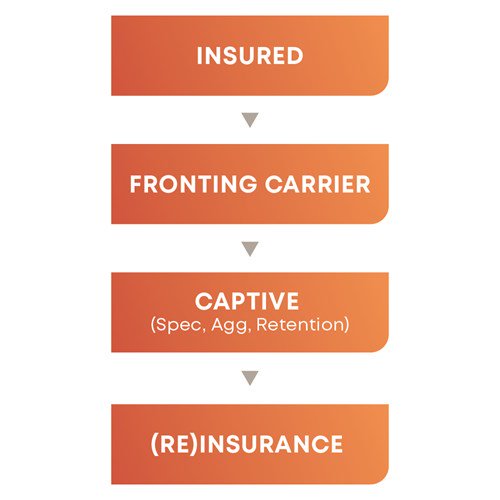

Typical reinsurance structures.

In terms of a general construct of a reinsurance single-parent captive, this diagram outlines the general components. As the construct indicates, a property single-parent captive is owned by an entity and may or may not use a fronting carrier. In turn, the risks originated by the fronting carrier are reinsured by the captive and, in turn, are retroceded to global reinsurance counterparties.

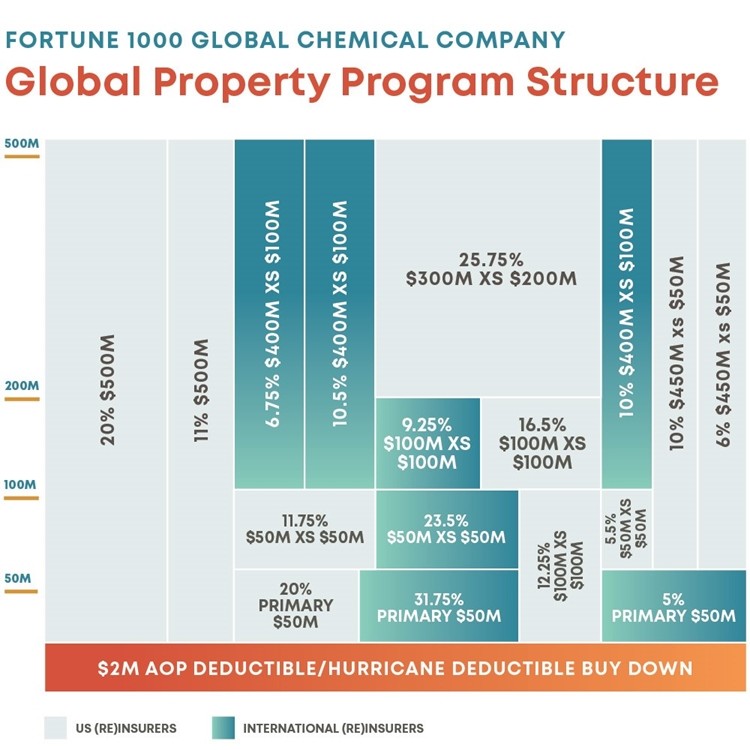

A second structure shows placement for a Fortune 1000 company. Here the syndicated layered solution attaches above business unit self-insured retention ($1 million AOP with two special deductibles for hurricane and a European plant).

Other services provided.

- Global catastrophe (CAT) modeling tailored to specific coverage areas and ZIP codes

- Legacy liability exit solutions

- Embedded risk management and loss protection resources such as fire protection and engineering risk studies, as well as outsourced risk management capabilities for complex risks

- Claim administration, reinsurance wordings and related strategies for captives